Yesterday we covered how the flow of invoices and funds work on 3D Hubs and today we’re going to tackle The invoicing process for the service fee from us to you, our Hubs.

Let’s dive right in!

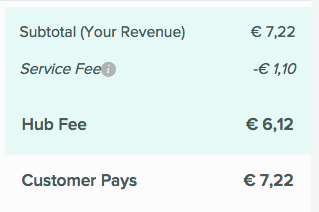

We provide for all* paid orders a service fee invoice. This service fee is indicated on the order page, as shown here:

This amounts 12,5 % (excl. VAT) of your revenue and is downloadable via your dashboard or via Hubs | On-demand Manufacturing: Quotes in Seconds, Parts in Days[ORDER NUMBER]/invoice.

The picture below is an example of what a non-business Hub receives. As you can see the total mentioned on the invoice equals the service fee on the order form (see picture above).

VAT on Service Fee invoices

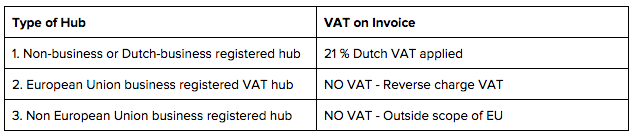

All service fee invoices related to orders that are created before 1 July 2015 have 21% Dutch VAT included, as we provide a general service to Hubs (not an electronic service that is charged with local VAT).

Since 1 July 2015, we use the reverse charge mechanism. What does this mean:

You can register as a business hub on your hub dashboard, if you are located in the European Union, don’t forget to provide your VAT number. If you have a business in the European Union, but you are not VAT registered, for example if you are self-employed, you cannot subtract VAT from your taxes, and therefore we will need to charge 21% Dutch VAT.

And that’s not all! Tomorrow will continue discussing receipts/ invoices to customers, so stay tuned

In the mean time, if you have any questions, feel free to comment below.

Cheers,

Gabriela

UPDATE: Click here for Episode 3: Receipts/Invoices to Customers

14 Likes

So you take 12,5% of the TOTAL amount INCL. tax and than add again 21% tax. I don’t think thats a fair way.

In this way the service fee will be even more than 12,5% because the fee will also be calculated over the tax.

If the total amount is 100,-. I need to pay 17,4 Tax. The ‘real’ price is 82,60. If 3D Hubs take 12,5% of this and than add tax, that will be fair. In that case 3D Hubs get 10,33 + 21% tax= €12,50

Right now Hubs take 12,5% of the total price. 12,5% of 100,- = 12,50 +21% tax= € 15,12

So if you can’t get the tax back, you pay 15,12% Fee.

Excuse me if i see it wrong.

MB3D

4

The current calculation method is similar to how the hubs have set the prices some time ago.

Back then hubs set the prices according to what they would finally earn, now we set the prices with the included 3dhubs fee.

Basically 3dHubs is saying that they get 12,5% of the cake and to get 12,5% they have to take 15,12% as they will have to give away 2,62% of their piece to the dutch government.

The calculation is wrong or their communication is wrong. You can’t calculate a percentage of the ‘sales price’ including tax and then treat this percentage as a fee without tax and add tax to that same percentage. You need to do both incl. tax or both excl. tax.

Another option is to communicate the real percentage and that is 15,12%. This is what people pay, it’s not about what 3D Hubs receive.

Hey @Rada3D, by now my colleague @menno3d should’ve already reached out to you to clarify things, case in point for your Hub. Let me know how that goes. Cheers

Hey Gabriela, I have contact with Menno so we can clarify things to each other.

It’s not that i don’t understand the way you communicate but i think there is a small error in the reasoning.

…which is why we really appreciate your feedback. Thanks for that!

Hi, @gabriela3d

Is it all possible to provide us with a collective bill, at the end of the month.

Maybe with different positions like for the regular orders and the fairphone orders?

It is always manual labor to add up the numbers and to be sure not to count orders twice.

Thank you in advance

Cheers Jan

Hey Jan, thanks for the nudge on it! We’ve heard the request many times too, so I’ll definitely bring it up with team. Cheers

@Filemon @Brian @menno3d

2 Likes